Production Volume Variance PowerPoint Presentation Slides PPT Template

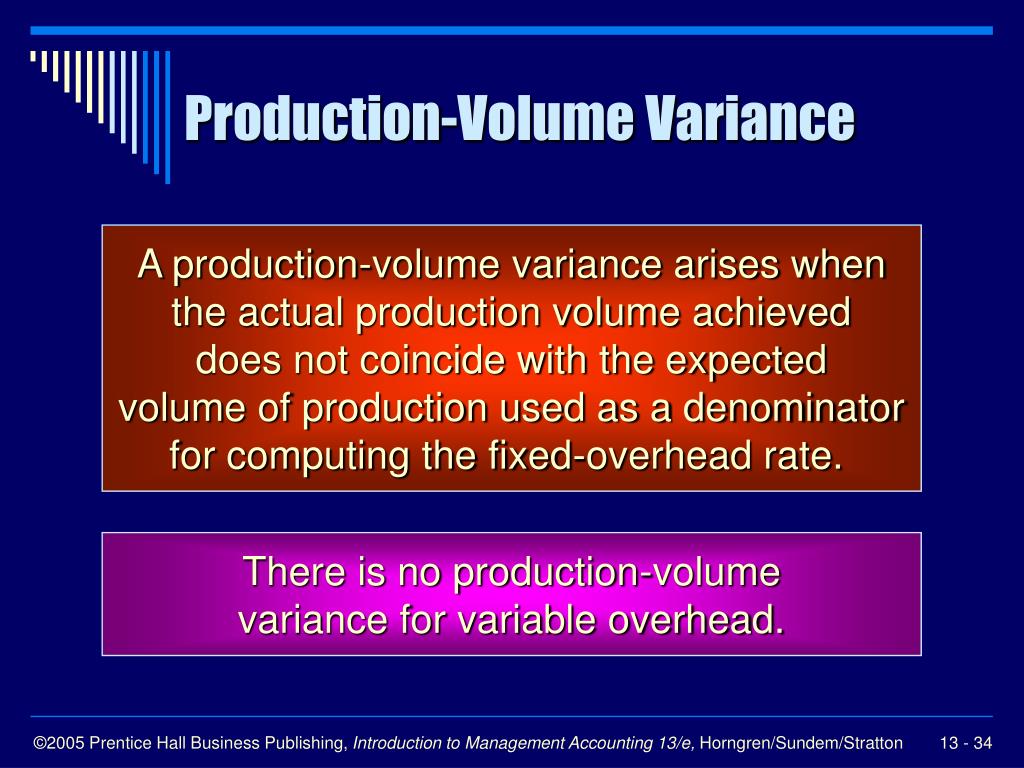

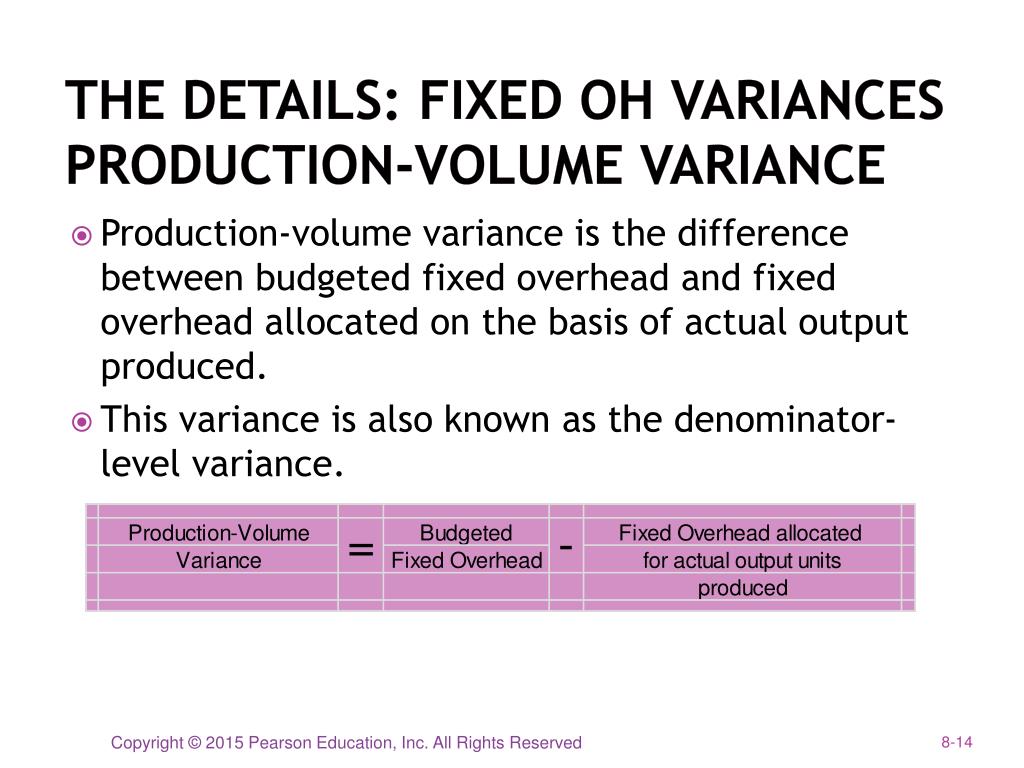

Definition of Production Volume Variance The production volume variance is associated with a standard costing system used by some manufacturers. This variance arises when there is a difference in the following amounts: The manufacturer's budgeted amount of fixed manufacturing overhead costs The a.

PPT Chapter 11 Standard Costs & Variance Analysis PowerPoint Presentation ID863490

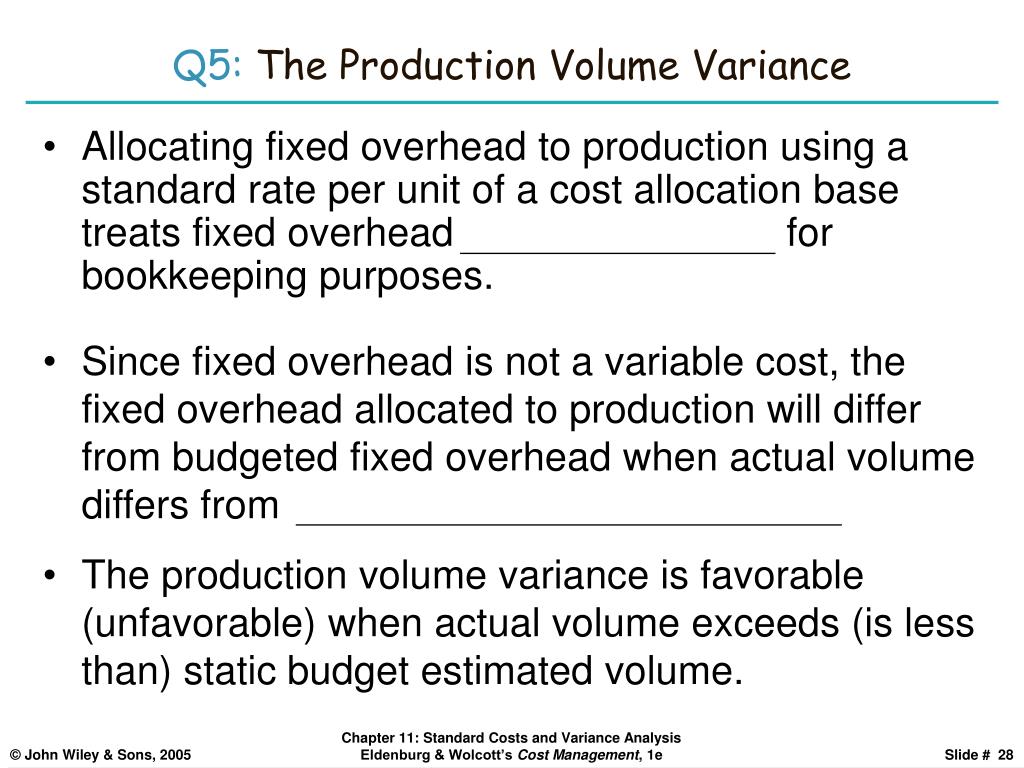

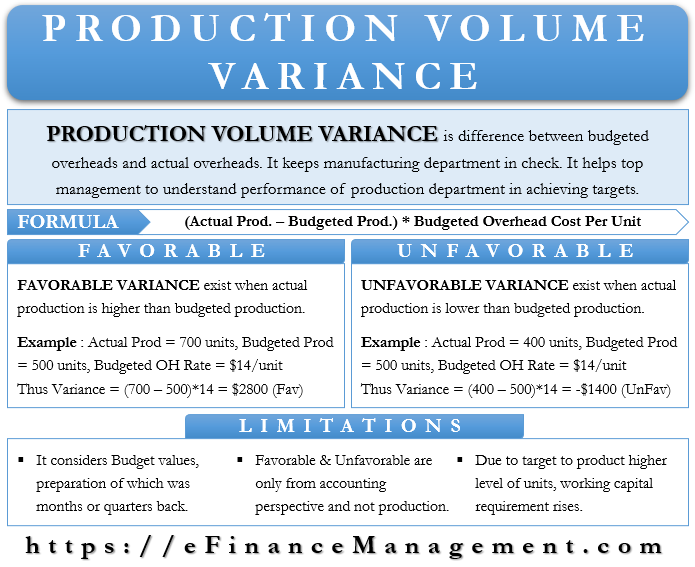

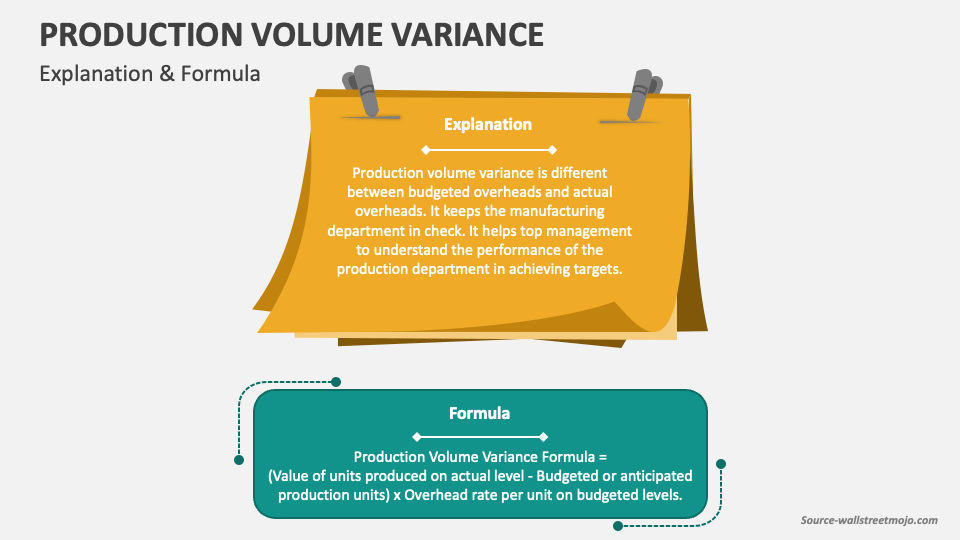

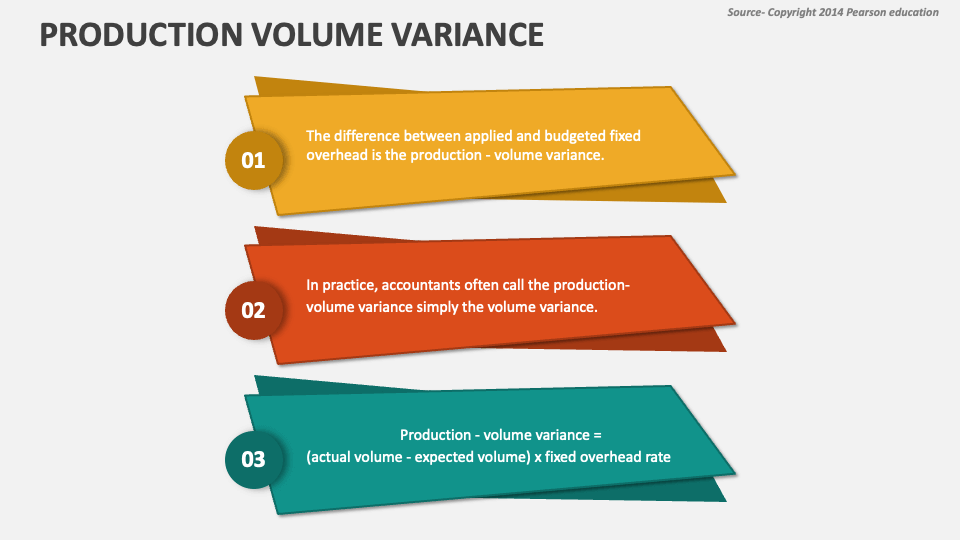

The production volume variance measures the amount of overhead applied to the number of units produced. It is the difference between the actual number of units produced in a period and the budgeted number of units that should have been produced, multiplied by the budgeted overhead rate.

PPT Accounting for Overhead . PowerPoint Presentation, free download ID4937220

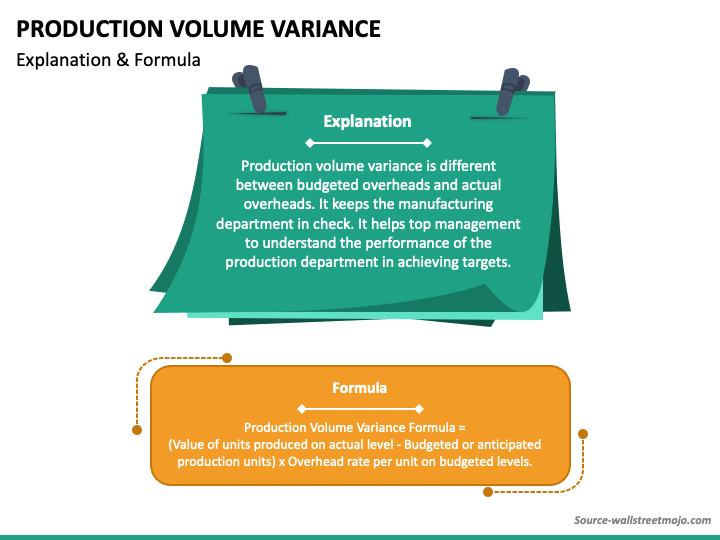

Production volume variance is a measure of the difference between the actual cost of producing a certain number of units of output and the budgeted cost of producing that output. It is a type of overhead variance, which is a variance that arises from the difference between the actual cost of overhead and the budgeted cost of overhead.

PPT Accounting for Overhead Costs PowerPoint Presentation ID268431

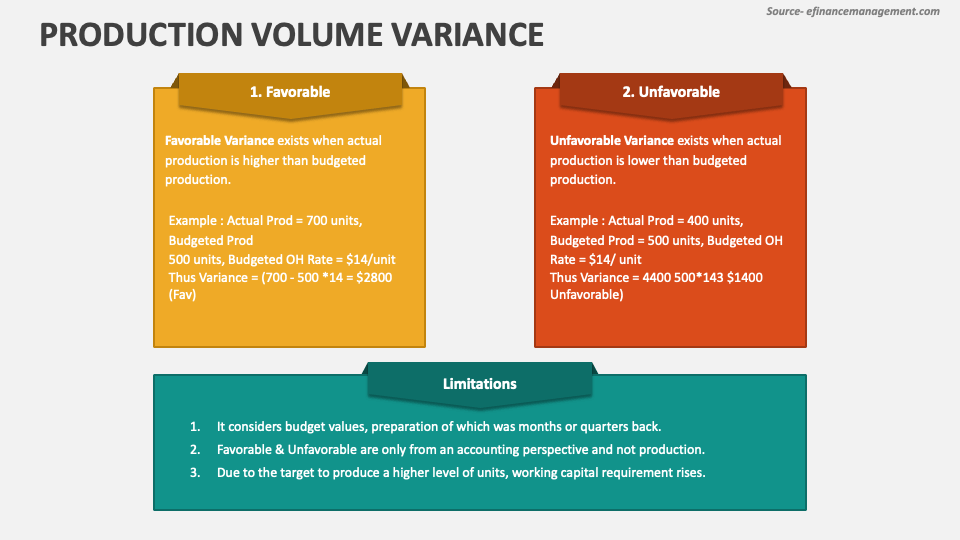

Fixed overhead volume variance = $19 x (950 units - 1,000 units) Fixed overhead volume variance = $18,050 - $19,000 = $950 (U) As a result, the company has an unfavorable fixed overhead variance of $950 in August. This is due to the actual production volume that it has produced in August is 50 units lower than the budgeted one.

PPT Variance Analysis PowerPoint Presentation, free download ID3405082

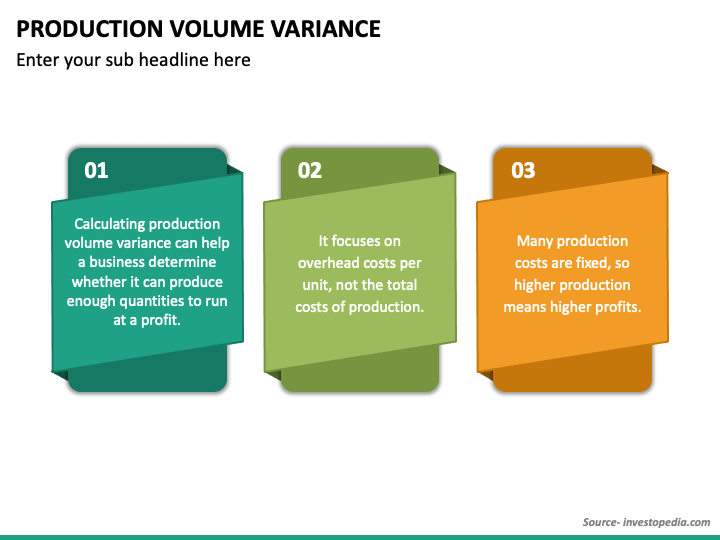

Production volume variance is a way that you can measure the actual cost of producing goods. And this gets done compared to the expectations that were outlined in your initial budget. Essentially, it compares your actual overhead costs per unit against your budgeted costs per item.

Production Volume Variance PowerPoint Presentation Slides PPT Template

Variances are computed for both the price and quantity of materials, labor, and variable overhead and are reported to management. However, not all variances are important. Management should only pay attention to those that are unusual or particularly significant.

Fixed Manufacturing Overhead Variance Analysis Accounting for Managers Course Hero

December 01, 2023 What is the Fixed Overhead Volume Variance? The fixed overhead volume variance is the difference between the amount of fixed overhead actually applied to produced goods based on production volume, and the amount that was budgeted to be applied to produced goods.

PPT Flexible Budgets, Overhead Cost Variances, and Management Control PowerPoint Presentation

The variable overhead spending variance can be calculated in the following manner: Standard Variable Overhead Rate ($12) − Actual Variable Overhead Rate ($10) = $2. Difference per Hour = $10 x Actual Labor Hours (100) = $1,000. Variable Overhead Spending Variance = $1,000. In such a situation, the variance is said to be favorable because the.

Financial Management Concepts in Layman's Terms

Production volume variance, also known as fixed overhead volume variance, is a measure used in cost accounting to quantify the deviation in actual production volume from the planned or budgeted production volume. It helps in understanding the extent to which a company's actual output differs from its expected output.

Production Volume Variance PowerPoint Presentation Slides PPT Template

Standard Fixed Overheads = Budgeted Fixed Overheads ÷ Budgeted Production. The formula suggests that the difference between budgeted fixed overheads and applied fixed overheads reflects fixed overhead volume variance. Also, there can be other bases for allocating fixed overheads apart from production units. These allocation bases can include.

Sales Volume Variance Definition, Formula, and Factors Influencing

The sales volume variance seeks to report the effect of the actual sales volume being different from the budgeted sales volume. If different numeraires are possible, then different values for the sales volume variance will exist for a given deviation between planned and actual sales levels.

PPT Chapter 15 PowerPoint Presentation ID268429

The production volume variance results from "unitizing" fixed costs" (Horngren, 2003 b, pp. 266/7). Hilton et al (2001) have a broader approach. Not only do they use the contribution margin .

Production Volume Variance PowerPoint Template PPT Slides

It can be calculated by using the following steps: Step 1: Firstly, determine the actual number of units consumed in material yield variance or the actual number of units sold in case of sales volume variance. Step 2: Next, determine the budgeted number of units planned for consumption in case of material yield variance or the budgeted number.

Production Volume Variance PowerPoint Presentation Slides PPT Template

A volume variance is the difference between the actual quantity sold or consumed and the budgeted amount expected to be sold or consumed, multiplied by the standard price per unit. This variance is used as a general measure of whether a business is generating the amount of unit volume for which it had planned. Types of Volume Variance

Production Volume Variance PowerPoint Template PPT Slides

Production volume variance = (actual units produced - budgeted production units) x budgeted overhead rate per unit Production volume variance is sometimes referred to simply as volume.

Production Volume Variance PowerPoint Template PPT Slides

As the chart below shows, of the total -$6.7M COGS variance, the total volume impact is -$3.8M. The logic behind the volume variance calculation is to separate: Actual mix by applying the actual volume with budget mix, and. Actual rate by applying the actual volume with budget rate. To analyze further, if there is no volume change, then there.